Debit Card Alerts

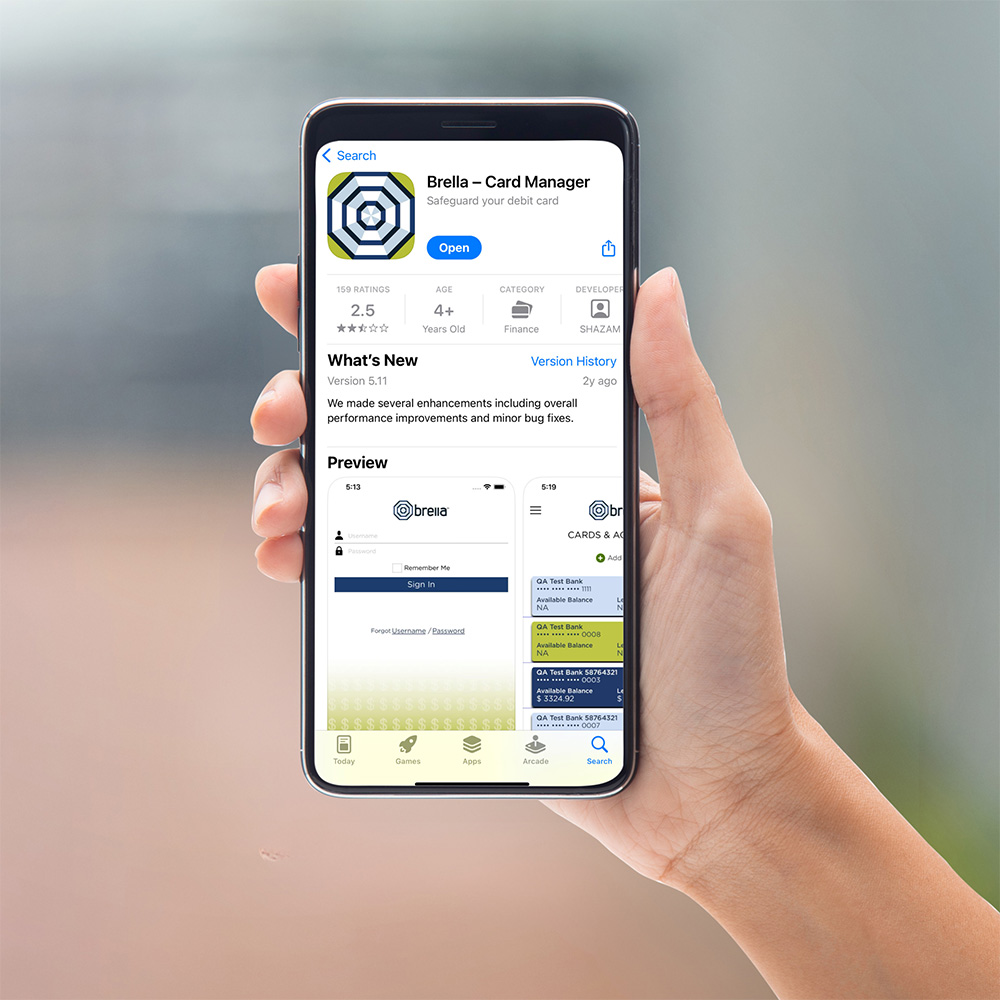

BRELLA APP

Mobile Convenience

With the Brella app, cardholders can access balance information on their smartphones, tablets and home computers. Brella users are able to pause their card with the transaction control feature and use GPS technology to locate nearby ATMs. Members can turn their cards ON/OFF if their card is lost, stolen, or suspicious activity occurs.

Reliable Fraud Protection

Like a high-tech early-warning system, Brella immediately sends alerts on any potentially fraudulent activity. When cardholders are aware of suspicious activity, they can contact JCU and put a stop to it.

Brella notifies cardholders of potentially fraudulent activities, 24/7, for the following:

- PURCHASES EXCEEDING CARDHOLDER-DEFINED THRESHOLDS

- CARD-NOT-PRESENT DEBIT TRANSACTIONS VIA PHONE, INTERNET, OR MAIL

- SUSPICIOUS OR HIGH-RISK TRANSACTIONS

-

PO BOX 1496

Des Moines, IA 50305-1496 - 800.828.8050

- Routing #273074229

At times, we may provide links to sites outside the control of our Credit Union. We do not make any representations concerning the linked sites’ contents or availability. You should review each site’s privacy and information security policies carefully before you enter confidential information. Deposit and loan products offered by Journey Credit Union. This credit union is federally insured by the National Credit Union Administration. The standard insurance amount is $250,000 per depositor.

At times, we may provide links to sites outside the control of our Credit Union. We do not make any representations concerning the linked sites’ contents or availability. You should review each site’s privacy and information security policies carefully before you enter confidential information. Deposit and loan products offered by Journey Credit Union. This credit union is federally insured by the National Credit Union Administration. The standard insurance amount is $250,000 per depositor.

Equal Housing Lender.

Equal Housing Lender.